Detroit citizens, in specific, still pay unfairly high costs about the rest of the state, Dumas stated."The consumer gets on the short end of the stick, this time with $400 in their pocket," she said. The press release stated the Michigan Catastrophic Claims Organization, a fund controlled by the insurance policy sector, will certainly complete the transfer of $3 billion in excess funds to Michigan's car insurance companies today.

To be eligible, locals needed to have actually an automobile guaranteed in Michigan last Oct. 31. Even more info regarding the refunds can be found on the website of the Michigan Department of Insurance Coverage and also Financial Providers. The MCCA has even more than $27 billion in possessions, according to its most recent monetary declaration, yet has been holding an excess, partially as an outcome of automobile insurance policy coverage modifications under the 2019 law.

That fee, which was $220 per automobile in 2019, has considering that been substantially decreased and is now just paid by vehicle drivers that decide for lifetime disastrous insurance claims protection. Whitmer said the fund will certainly continue to hold $2 billion in excess funds "to guarantee connection of care for tragic crash survivors.

Yet a political delay has hung over the Capitol for several years as a term-limited Legislature that loses lots of participants every two to 4 years has actually been incapable to locate a compromise that makes sure lower insurance policy prices without gutting what's considered the very best clinical insurance coverage for vehicle mishaps in America."The problem is, no one seems ready to actually put drivers initially because they're all just giving way excessive money," stated Bernstein, a Democrat whose family law company represents damaged motorists in so-called third-party "pain and also suffering" claims against at-fault chauffeurs.

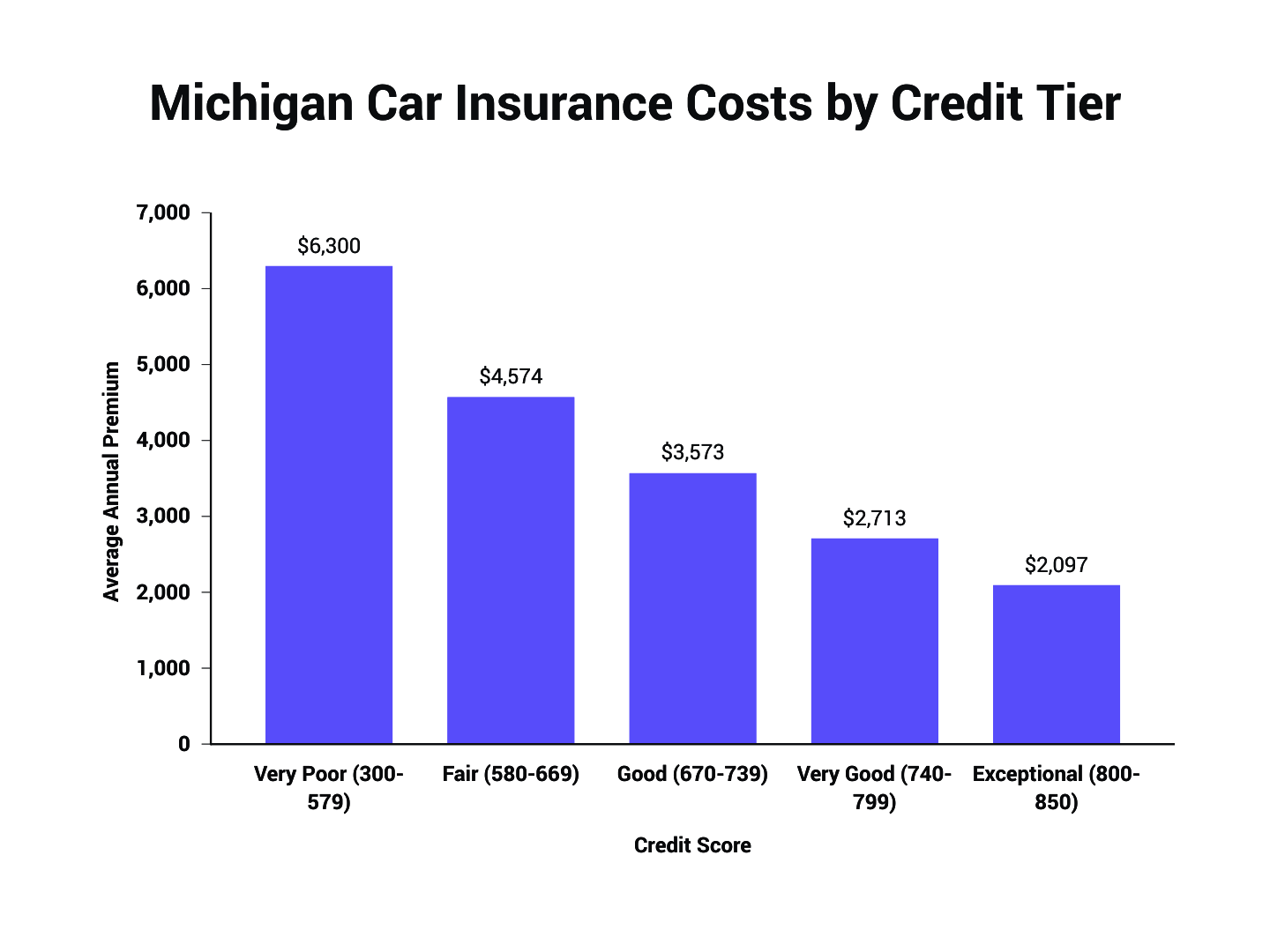

Lawmakers remain deeply divided over paring back what's considered the best medical treatment in America that cash can get for damaged motorists as well as guests while the insurance market remains to establish private rates based upon where a driver lives, their education degree, credit report score, marital condition and also other variables that have nothing to do with driving."The best strategy is to include costs and also make certain rate relief to Michigan drivers without reducing the advantages people require when they're in catastrophic vehicle accidents," stated Rep.

3 Easy Facts About How Much Is Car Insurance In Michigan? Shown

Complicating efforts to locate compromise in Lansing are departments amongst the various services included over placing into state legislation set payment prices for medical companies and also mandated double-digit rollbacks in the costs insurers can charge in an affordable market. The Michigan Health & Healthcare facility Association has supplied in the past to voluntarily freeze its costs for a set duration of years, but has steadfastly stood up to a government-mandated charge routine."For the carriers, that resembles us bring out a proposal that says automobile insurance firms can not make use of ZIP codes to set their prices," stated Chris Mitchell, elderly vice head of state of advocacy for the healthcare facility organization.

Qualified Michigan motorists will start seeing $400 reimbursement checks starting today. Here's everything you require to know. Gov. Gretchen Whitmer as well as the state's top insurance regulatory authority claimed Monday that a $3 billion transfer of surplus funds from the Michigan Catastrophic Claims Organization to cars and truck insurance firms will certainly be finished today.

Checks can show up in the mail for some beginning this week. Extra: We've obtained numerous inquiries concerning the reimbursement checks, so below's a summary of solutions to one of the most usual ones. That is qualified to obtain a reimbursement? All cars that were insured since 11:59 p. m. on October 31, 2021 are qualified to obtain a refund if the car was covered by a plan that fulfills the minimum insurance policy demands for operating a lorry on Michigan roads.

If you are qualified to obtain a refund, it will certainly be sent out to you by your insurance coverage company as well as you will certainly not need to do anything to receive it. Are motorbikes and/or Motor homes eligible? Yes, bikes as well as RVs are qualified for the $400 reimbursement if the motorcycle or RV was covered by a policy that fulfills the minimum insurance needs for operating on Michigan roadways.

What if I moved considering that Oct. 31, 2021? Your insurance provider will send your reimbursement using check or ACH down payment to the address or savings account it carries document. To avoid delays in getting your refund, if you have actually relocated, you ought to call your insurer to ensure it has your present information.

The Facts About Michigan Car Insurance ~ Get A Free Quote - Geico Revealed

Individuals who deducted their vehicle insurance coverage premiums as a company cost might be required to include all or a section of this reimbursement as revenue on their income tax return. Please consult your insurance representative or tax obligation professional if you have concerns concerning your specific condition. What happens if I transformed insurers since Oct - affordable.

m., will certainly be liable for issuing the refund. Ad, The state claimed qualified consumers who do not get refunds need to call their vehicle insurance provider or agent. Those who are not able to deal with concerns or concerns can contact the state Division of Insurance as well as Financial Solutions. The catastrophic treatment fund, which compensates insurance firms medical as well as other prices for people seriously hurt in accidents, is funded with a yearly per-car charge that came to be optional under a 2019 regulation.

Michigan vehicle drivers with auto insurance coverage will quickly beginning getting previously announced $400 reimbursements per automobile. Gov. Gretchen Whitmer and also the state's leading insurance regulatory authority stated Monday that a $3 billion transfer of excess funds from the Michigan Catastrophic Claims Association to cars and truck insurance firms will be finished this week - cars. The firms will certainly have 60 days to release the refunds no behind May 9.

insured car low cost low cost low-cost auto insuranceinsurance affordable laws cheaper car insurance insurance affordable

insured car low cost low cost low-cost auto insuranceinsurance affordable laws cheaper car insurance insurance affordable

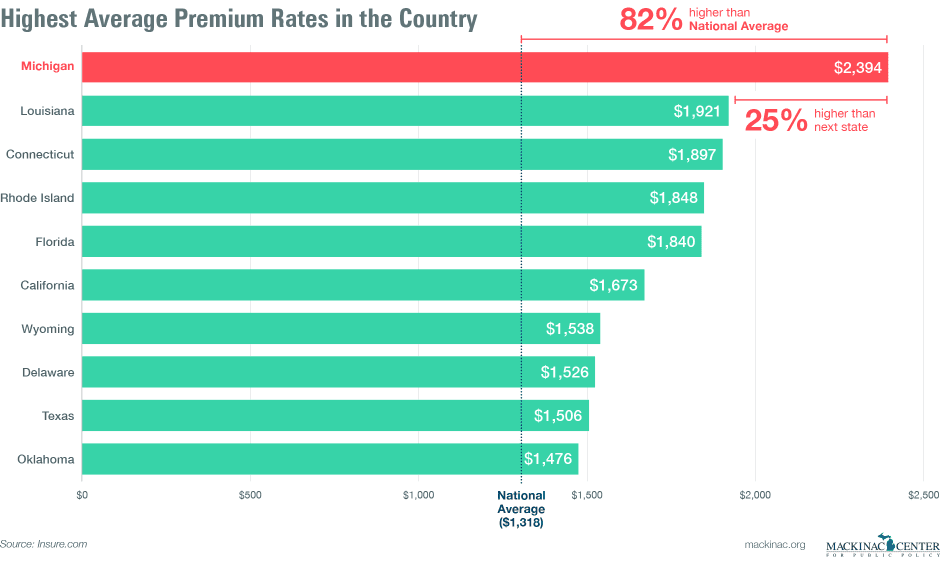

Q Why is automobile insurance pricey in Michigan? A Michigan has one of the most pricey minimum coverage levels in the entire country. Michigan's no-fault insurance law makes it compulsory for the drivers to cover the losses by themselves, doesn't matter that was at mistake. This is the main reason that car insurance coverage has too expensive prices in Michigan.

These aspects can be your driving background, your credit history, type of vehicle, and also the area where you live. Usually, the car insurance rate in Michigan is $3141. 00 each year for full protection or $262 - low cost. 00 monthly. Q That has the most inexpensive liability insurance coverage in Michigan? A GEICO has the most inexpensive obligation insurance in MI.

00 while the typical Michigan auto insurance policy rate for the state minimum insurance coverage is $1855. Q What is the car insurance coverage price in leading Michigan cities? An Insurance policy firms in Michigan State compute the insurance expense based on a number of elements like age, credit history score, and also zip code.

Facts About Michigan Car Insurance - Usaa Revealed

Michigan drivers pay a standard of $2,377 per year for a full insurance coverage automobile insurance coverage policy, making it one of one of the most pricey states in the U (auto insurance).S for auto insurance. We do not offer your info to 3rd events. Prices additionally differ widely depending on where in Michigan you are in Detroit, the ordinary rate for a complete coverage plan is $5,357 each year while Grand Rapids drivers pay simply $2,138 a year for the exact same insurance coverage.

The even more tickets as well as accidents you have on your record, the greater your rates will be. Drive with treatment, prevent accidents, as well as stay within uploaded speed limits if you desire a better rate on your auto insurance policy. If you already have an erratic record, make certain to look around to locate the companies that will certainly still offer you budget friendly rates.

Exactly how much vehicle insurance is called for in Michigan? Depending on your health insurance coverage, you might have to obtain at the very least $500,000 of individual injury security.

Unlike most no-fault states, the amount of PIP called for in Michigan depends on your health insurance coverage. risks. Policygenius has assessed auto insurance policy prices offered by Quadrant Info Provider for every ZIP code in all 50 states plus Washington, D.C.

Rates provided are offered sample of costs.

The Facts About Detroit And Michigan Lead The Nation With The Highest Auto ... Uncovered

This Michigan auto insurance policy covers damage you cause to parked cars or other residential or commercial property (i. e (cheapest car). buildings, fencings, trees, yards, etc) within the state of Michigan. Every Michigan car policy has a mandatory $1 Countless PPI protection. Safeguards you in case you cause a vehicle accident that caused major injuries to somebody else.

The legislation needs a minimum of $10,000 of PD insurance coverage. Our attorneys recommend that you lug a minimum of $100,000. If you travel to Ohio, which is a tort state (Michigan is a No-Fault state) and also you cause a crash, you would certainly be accountable for all of the various other motorist's car damages - credit.

Have a look at our FAQs regarding Michigan mini tort. Covers distinction in value in between what an automobile deserves and also what is owed on it. This is basically life insurance policy in case you or a traveler is killed in a car accident.

Usually car insurance firms will charge a lot more for younger chauffeurs as well as provide reduced prices for older drivers (car). Insurance coverage providers see young motorists as unskilled and have a higher danger of obtaining in accident.

cheapest car insurance car car cheaper auto insuranceperks business insurance perks credit

cheapest car insurance car car cheaper auto insuranceperks business insurance perks credit

37 Generally, motorists that presently have cars and truck insurance policy protection will certainly receive a more affordable month-to-month rate than drivers who do not. Because automobile insurance policy is a demand in all 50 states, companies might doubt why you do not currently have protection. Due to this, they might see you as a higher risk motorist - vehicle.

Insurance coverage, Avg month-to-month rate Full Protection $140. 84 Obligation Just $104. 86 The statistics noted on this web page are from our own in house coverage. We track as well as tape-record quotes that service providers have actually given based on different requirements. The prices as well as averages revealed on this page needs to just be used as a price quote.

Things about Michigan Car Insurance

Michigan's vehicle insurance prices dropped 18% in 2020 compared to what they were the previous year. car insured. That's according to a national research study from an on the internet insurance policy comparison internet site, . According to the research, Michigan's rates went from an average of $3,106 in 2019 to approximately $2,535 in 2020.

PIP medical protection make up virtually half of the costs of a car insurance coverage bill, so the capability to quit spending for it implies significant possible savings for Michigan motorists. Several had already seen an effect when WDET examined in back in September. Warren resident Madison Poteat claims she went from paying $745 a month for two automobiles to $285 a month, without also changing insurance coverage firms.

In total, WDET's unscientific study of about 20 individuals in September found that chauffeurs generally saved $174 a month, or 33% off of what they had previously paid. Currently the research study by The, Zebra. com backs up the finding that the regulation has actually caused savings for Michigan chauffeurs and also the state is running into comparable findings.

Take a look at our FAQs regarding Michigan mini tort. Covers difference in value in between what an auto deserves as well as what is owed on it. This is essentially life insurance policy in the event you or a traveler is eliminated in an automobile crash.

Generally automobile insurance coverage business will certainly charge much more for more youthful vehicle drivers and also supply reduced prices for older drivers. Insurance coverage service providers see young vehicle drivers as inexperienced and have a higher threat of obtaining in mishap.

37 Most of the time, vehicle drivers that currently have vehicle insurance policy protection will certainly obtain a more affordable month-to-month rate than vehicle drivers who do not. Given that vehicle insurance is a demand in all 50 states, firms may wonder about why you do not currently have insurance coverage. As a result of this, they may see you as a greater danger chauffeur.

The Best Strategy To Use For Auto Insurance Rates Expected To Rev Up In Michigan This Year

Protection, Avg regular monthly rate Full Insurance coverage $140. 84 Responsibility Only $104. 86 The stats noted on this web page are from our very own in house reporting. We track and also tape quotes that carriers have given based upon various requirements. The prices and also averages revealed on this page needs to just be utilized as a quote.

Michigan's car insurance prices decreased 18% in 2020 contrasted to what they were the previous year. That's according to a national study from an online insurance policy contrast web site, - car insured. According to the study, Michigan's prices went from an average of $3,106 in 2019 to approximately $2,535 in 2020.

PIP clinical protection make up virtually fifty percent of the expenses of an auto insurance coverage bill, so the ability to stop paying for it implies substantial prospective cost savings for Michigan vehicle drivers - low-cost auto insurance. Many had currently seen an effect when WDET examined in back in September. Warren resident Madison Poteat states she went from paying $745 a month for 2 automobiles to $285 a month, without even changing insurer.

In total amount, WDET's unscientific survey of around 20 people in September discovered that chauffeurs on typical conserved $174 a month, or 33% off of what they had formerly paid. Now the study https://car-insurance-chatham-illinois.s3.ap-southeast-2.amazonaws.com by The, Zebra. com backs up the searching for that the law has brought about savings for Michigan vehicle drivers and the state is experiencing similar searchings for.