If you live in an at-fault state and also another driver creates the mishap, then you can stay clear of paying your insurance deductible. The procedure behind that can take time (cars). Some insurance policy experts advise you to pay your deductible by opening up an insurance claim with your insurance coverage business, as well as your insurance provider can work to get that money repaid for you.

Vehicle Insurance Policy Deductible FAQs, Having a $1,000 insurance deductible methods that if you're entailed in a crash or an event, you are required to pay the first $1,000 for repair services prior to the insurer starts paying your benefits. Yes, the majority of cars and truck insurance deductibles are assessed on a per-claim basis. This implies that each time you sue, you will be called for to pay your deductible.

cheaper car credit low cost auto car

cheaper car credit low cost auto car

Normally, $1,000 is the highest deductible you'll see from most insurance coverage suppliers. The expression out of pocket usually refers to wellness insurance policy plans where you have a maximum amount of cash you 'd have to pay within a year.

If you have a Waiver of Deductible Endorsement included on your plan and satisfy the requirements as described in the recommendation your company will certainly waive your insurance deductible if particular requirements are fulfilled. Your vehicle was lawfully parked when it was struck by an additional automobile possessed by a determined individual.

Your vehicle was struck in the back by an additional automobile moving in the exact same instructions as well as possessed by a recognized person. The operator of the various other vehicle was convicted of any of the complying with violations: a. Operating while under the impact of alcohol, cannabis or a narcotic medication. The deductible would not be waived if the driver of your protected car under this Part was additionally convicted of one of the offenses.

While the majority of insurance provider utilize the same Waiver of Insurance Deductible Recommendation, you need to get in touch with your provider regarding the certain language of your recommendation. Without the recommendation affixed to your vehicle policy, there is no need that the firm waive your insurance deductible, no matter any kind of at-fault or not at-fault findings.

This would certainly be as a client service, however they are not called for to do so.

When asking for cost quotes, it is crucial that you give the same information to every representative or business. The agent will normally ask for the complying with info: description of your car, its use, your vehicle driver's license number, the variety of chauffeurs in your family, and also the protections as well as restrictions you want.

You will be asked to address several inquiries about yourself, where you live, your preferred level of coverage, and your auto or home. Responding to these concerns to the finest of your ability should cause a far better rate estimate - vehicle insurance. Where to Shop, Check online, the newspaper and also yellow web pages of the phone book for business as well as agents in your location.

What Does 6 Things To Know About Deductibles In The Health Insurance ... Mean?

Specifically, inquire what sort of claim service they have obtained from the business they suggest. Bear in mind to search to get the most effective rate as well as solution. You can locate a listing of insurer and also their market share in South Carolina on our Market Support web page. For Your Protection, Once you have chosen the insurance protections you require and an insurance agent or company, there are steps you can require to make particular you obtain your money's worth.

It is unlawful for unlicensed insurance firms to market insurance and, if you buy from an unlicensed insurance provider, you have no warranty that the insurance coverage you spend for will ever before be honored. Review Your Policy Thoroughly, You must understand that a car insurance policy is a legal contract. It is composed so your legal rights and also obligations, in addition to those of the insurer, are clearly specified.

You must read that policy and make sure you understand its contents. If you have questions concerning your insurance plan, call your insurance coverage representative for explanation.

Things You Need To Know BEFORE You Submit Your Case Dear Most Valued Customer, You're most likely reading this due to the fact that you lately had an automobile accident or endured some various other kind of loss to one of your lorries, your residence or your business. And also you're wondering Should I submit an insurance claim to my insurance policy business or not? Can my policy be terminated and also what takes place then?

credit vans auto insurance cheaper

credit vans auto insurance cheaper

What's right for your neighbor isn't necessarily ideal for you. Offered the same facts you each could make a different choice. The bottom line is this If you're concerned concerning the possible effect of sending your insurance claim, contact us as well as review your situation! (This is just among the numerous advantages of working with me and also my devoted team as opposed to some faceless 800 number somewhere.) We're right here to encourage and also counsel you to clarify how your insurance coverage really works - insurance companies.

What To Do When A Car Insurance Company Refuses To Pay Fundamentals Explained

Currently right here are the extra important variables that enter into play. First Isn't This What My Insurance Is For? Yes insurance coverage is for paying cases. You choose the protection choices as well as limitations you desire. You pay your premium. Your insurance provider pays your covered cases. That's the offer. Why all this talk about the "effects" of cases? Why can insurance claims enhance my cost and even get my plan canceled? That's what insurance policy is for! That's absolutely real.

affordable car insurance cheapest auto insurance low cost auto low cost

affordable car insurance cheapest auto insurance low cost auto low cost

I do not intend to transform this record into an insurance policy guidebook, and you don't desire that, either! But this is an usual inquiry I obtain from clients, so I wish to explain it to you below very just. Insurance coverage, and also the rate you spend for it, is based on danger the threat of a loss occurring.

And also low danger of loss suggests lower rates. Make good sense? Now, what determines the degree of danger? Great deals of things. But cases experience is one of one of the most vital. Statistics show that people who have a claim are most likely to have an additional insurance claim. So, when contrasted to someone without any previous claims, somebody with cases on their document represents a higher threat of loss to the insurance provider.

When you have an insurance claim you currently stand for greater threat of future loss to your insurance policy company. The Dimension of Your Loss If it's not evident, this discussion regarding whether or not to send your claim actually just comes right into play with little losses losses that come close to your insurance deductible.

That IS what you purchase insurance policy for! Occasionally it simply makes sense to pay your loss yourself and also prevent the repercussions of sending a case.

Some Known Facts About Do I Pay My Deductible If I'm Not At Fault? - Hensley Legal ....

If your insurance deductible is $1,000 and also your suffer $800 in problems, after that your insurance coverage business isn't going to pay anything. The quantity of damage is much less than your insurance deductible.

What if the loss is simply a little bit more than your insurance deductible quantity? What if your deductible is $1,000 as well as the damages is, claim, $1,200? In this instance, your damages are only $200 even more than your insurance deductible.

Did Someone Get Pain? Lots of cases include only building damage. As an example, maybe the wind strikes some shingles off your roof. Or possibly you back right into a pole in a car park whole lot. The point is no one's hurt. There are no injuries. When your loss includes home damages only, it in some cases makes sense to take treatment of it on your own and also prevent the repercussions that feature sending the case.

Some companies have a rate for simply about everyone. That means that no issue how poor your insurance claims record obtains they'll keep you insured - insured car. On the various other hand, some companies don't have a rate for everyone.

When that happens you'll be required to obtain insurance coverage elsewhere, as well as it's most likely you'll pay a dramatically greater cost with a new business. State Laws State insurance legislations shield you, the customer.

The Only Guide for 5 Ways To Keep Your Car Insurance Costs Down - Consumer ...

State legislations, company regulations and practices, the dimension of your loss, your deductible and your personal cases background and also experience all mix with each other to develop your special conditions. If you're questioning whether or not it makes any feeling to submit your case, offer me and my team a phone call.

And after that make an informed decision.

Accidents happen. Whether an auto collision is your mistake or somebody else's, your automobile insurance policy coverage should assist you. This is figured out by the mix of alternatives that comprise your insurance coverage policy.

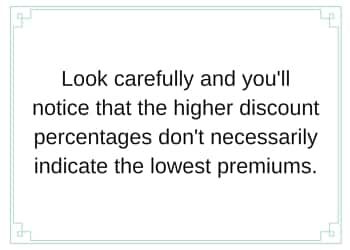

Think about deductibles as well as premiums as well as driving experience and also track records when picking an insurance company. What Automobile Insurance Do You Required? Vehicle insurance can feature a large cost, especially if you stay in specific states. Don't make the mistake of opting out simply to save the additional money since leaving it up to destiny may cost you much more if you finish up in a vehicle accident or have damages to your lorry that isn't your fault.

You can choose to obtain insurance in Virginia or Visit this link pay the state federal government's department of electric motor cars a $500 charge. But homeowners drive at their very own risk and also are in charge of any damage to their car or somebody else's. Liability insurance coverage includes liability for both physical injury and also home damage.

The Main Principles Of How Can I Avoid Paying My Car Insurance Deductible? - Jerry

Both can protect you financially from individual suits stemming from crashes - dui. Without Insurance Chauffeurs An Insurance coverage Study Council research study released in 2021 recommended that as lots of as one in 8 at-fault vehicle drivers on the roadway are uninsured.

The lesson below is that you should rely on various other drivers and also do not take for provided that they will certainly have as excellent coverage as you do.

insured car car insurance dui cheaper cars

insured car car insurance dui cheaper cars

If the accident is not your mistake, the other chauffeur's insurance policy (or your without insurance motorist protection) will pay for the automobile. In those instances, you can just rely on your very own insurance coverage.

State regulations, firm rules and methods, the size of your loss, your deductible and also your personal cases history and experience all mix with each other to create your unique circumstances. cars. If you're asking yourself whether it makes any kind of feeling to send your claim, offer me and my group a telephone call FIRST.

And afterwards make a notified choice - affordable car insurance.

Everything about Not At Fault In Car Accident: Who Pays? - American Family ...

Mishaps occur. When they do, insurance is what maintains our finances protected - insurance company. Whether a car accident is your mistake or somebody else's, your auto insurance coverage should aid you. However how much it assists depends on you. This is identified by the mix of choices that comprise your insurance plan.

Take into consideration deductibles and premiums along with driving experience and record when picking an insurance company. What Automobile Insurance Do You Required? Auto insurance coverage can come with a large cost tag, especially if you stay in particular states. cheap auto insurance. But do not make the mistake of pulling out simply to save the money because leaving it as much as destiny may cost you much more if you wind up in an auto accident or have damage to your car that isn't your fault.

You can select to obtain insurance in Virginia or pay the state federal government's division of motor lorries a $500 fee.

Both can safeguard you monetarily from individual legal actions stemming from mishaps. cars. Without Insurance Drivers An Insurance Research Council research study launched in 2021 suggested that as numerous as one in eight at-fault motorists on the road are uninsured.

The lesson here is that you must rely on other chauffeurs and also don't consider provided that they will certainly have as great coverage as you do. It can be hard to digest that you have to pay a costs and the insurance deductible for someone else's error, it's far better than abandoning this insurance coverage and also running the risk of shedding your car. vehicle insurance.

The Best Guide To Automobile Insurance - Florida Department Of Financial ...

If the crash is not your mistake, the other motorist's insurance coverage (or your without insurance vehicle driver coverage) will pay for the vehicle - dui. In those situations, you can only depend on your very own insurance.